Here’s a really cool strategy that’s overlooked in the real estate investing space but has a huge potential to make you a lot of money, especially in a tight market when deals are hard to come by. Because simply looking for what everyone else is doing at this time is insufficient. You have to think outside the box and not just find a good deal, but make a good deal with a more creative approach to identifying good real estate investment opportunities.

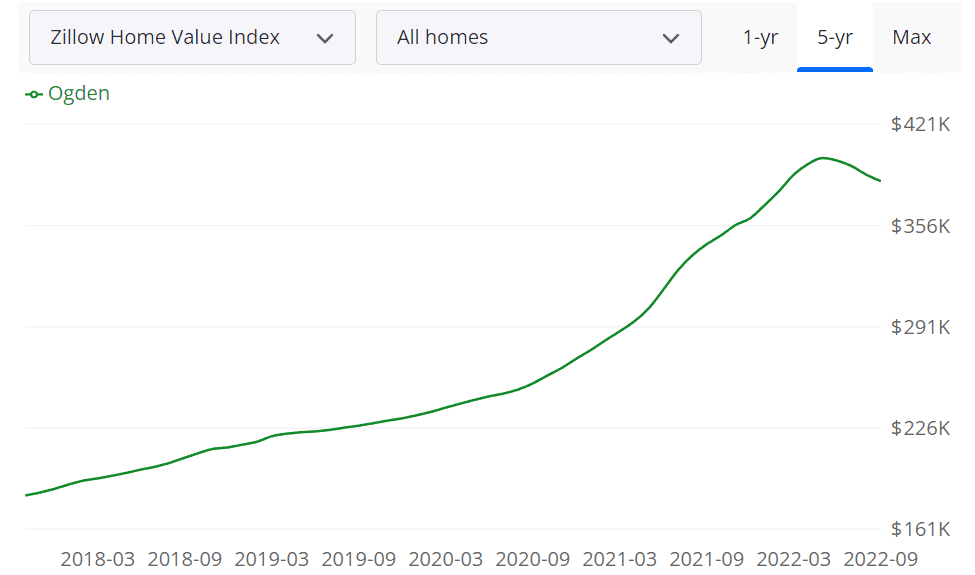

Over the past three years, I have personally used this strategy to gain nearly $500,000 in equity, including a house I sold last year for a $100,000 profit. And then we recently bought a home in Ogden, Utah, a really expensive market where housing prices have more than doubled over the past five years and have appreciated 50% over the past three years alone. And with the addition of the second of the property’s two rental units, we’re working toward living pretty much for free in this home.

I started investing in real estate using this strategy, and I’ve since bought six properties using the same strategy. All of them had extremely positive cash flow, usually $1,000 per month net if I rented both units out or lived for free while earning some small amount of cash flow. Since then, I’ve expanded this concept into commercial real estate, and as of right now, my partner and I own five boutique hotels through our business, Adventure Stays. We expect to generate $3M in revenue this year alone. So the plan is to search for single-family homes with extra units, whether it be a mother-in-law apartment, guest house, basement apartment, or really any other type of rentable space or unit on the property. This is different from duplexes, triplexes, and fourplexes, which are marketed as multifamily properties. So the market for these small multifamily homes has actually increased as house hacking has grown in popularity as a strategy for entering the real estate investment with low risk and low out-of-pocket costs.

That’s because you can get a residential loan on anything four units or under, so you can get the lowest down payment and you can get the lowest rates by making the property your primary residence and then renting out the other units. And the method I’m going to discuss can be applied to both house hacking and pure investment properties that you don’t live in. I bought houses under both scenarios with really good results on both of those. And the reason for finding a single-family house with an extra rentable unit is so powerful is that houses with extra units are less sought after, even though they have the same appeal from an investment standpoint as the extra unit. And when real estate agents get these listings, they frequently list them incorrectly, under-market them, or even forget to include the additional rentable unit. I found several of the houses that I’ve bought with an extra unit just by scrolling through pictures and finding an extra kitchen or something like that in the pictures and then putting the pieces together about how it could be turned into that extra unit. So you have a lot less demand and competition from the buying side and you can purchase the house for the price of just the house. The extra unit is not usually priced in like it is with a duplex or a triplex.

They are frequently priced per listing. Additionally, with single-family houses, this extra unit, they’re usually valued as a square foot approach based on comps in the area. And as this strategy grows in popularity, you’re going to benefit on the back end with the increased equity. Particularly if you decide to sell it and work with a savvy agent who understands how to promote homes properly to highlight the characteristics and unique qualities of the home.

But how? You could live in it as a prospective buyer or as an investment property with a house hack.

And although prices are beginning to level out and even decline in certain locations, high mortgage rates are simply chopping the legs off the affordability for buyers. As a result, buyers are currently being pushed further away from the market. Multi-generational living I think is going to become a big thing going forward. Think of a place like Hawaii where home affordability in its own is its own epidemic. And because of the high cost of housing, it is common to have three generations living together under the same roof since the grandchildren or the children cannot afford to live independently or have their own place. It’s a big reason why Ohana units there that extra rental unit is a big thing.

I think the same thing is going to happen or will already be happening across the country as wages raise way lower than home prices. In this case interest rates, both of which hurt affordability for buyers and create additional demand for houses with the extra living spaces to accommodate for these multigenerational families living together. So the typical home will spend more time on the market. As time passes, you will have a larger buyer pool if you have a house with an extra unit on the market. But the good news is that you can still get in and find these under-marketed, under-utilized homes right now to get good offers.

If you’re a buyer hoping to enter the real estate investing industry or an investor looking for deals, know buyer looking to house hack.

Here’s how to find properties like these with some of the search filters and other strategies that I use there. Let’s dive into the details of this method since knowing that it works is one thing, but actually knowing how to implement it and knowing what to look for while you are actually looking at properties is quite another.

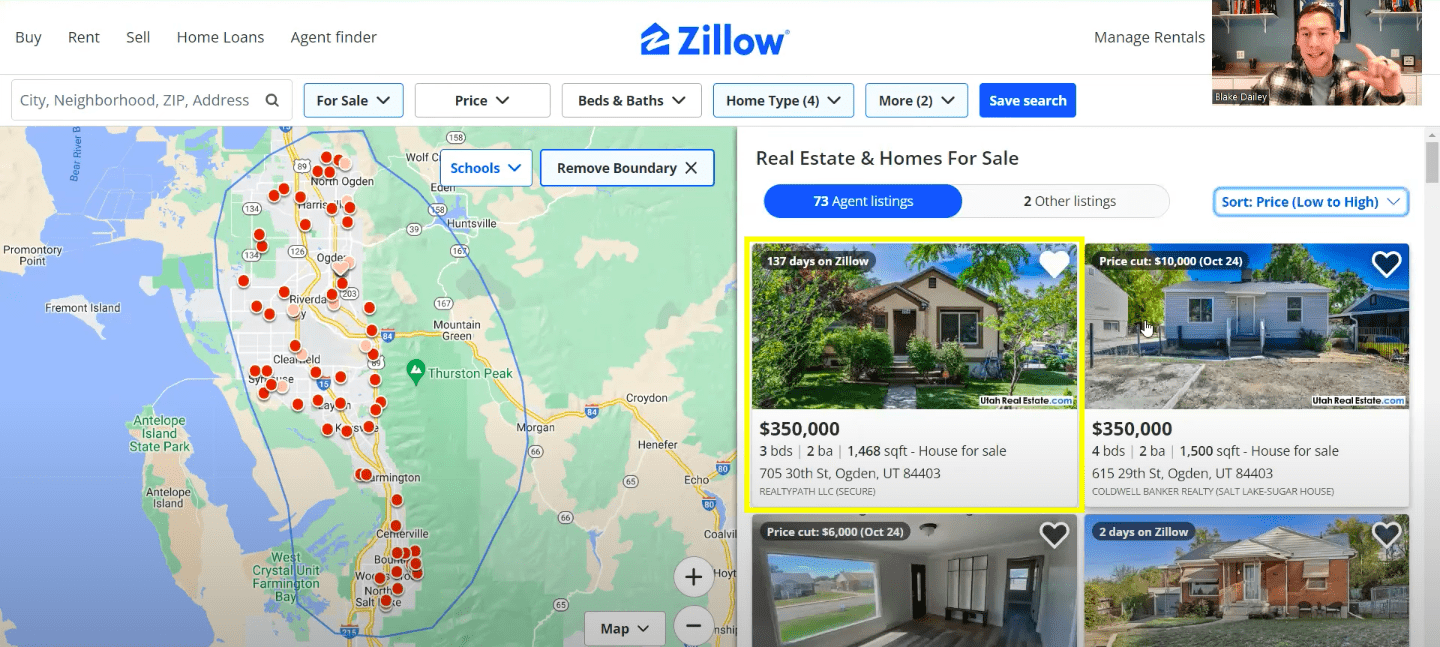

Let’s go check out Zillow.

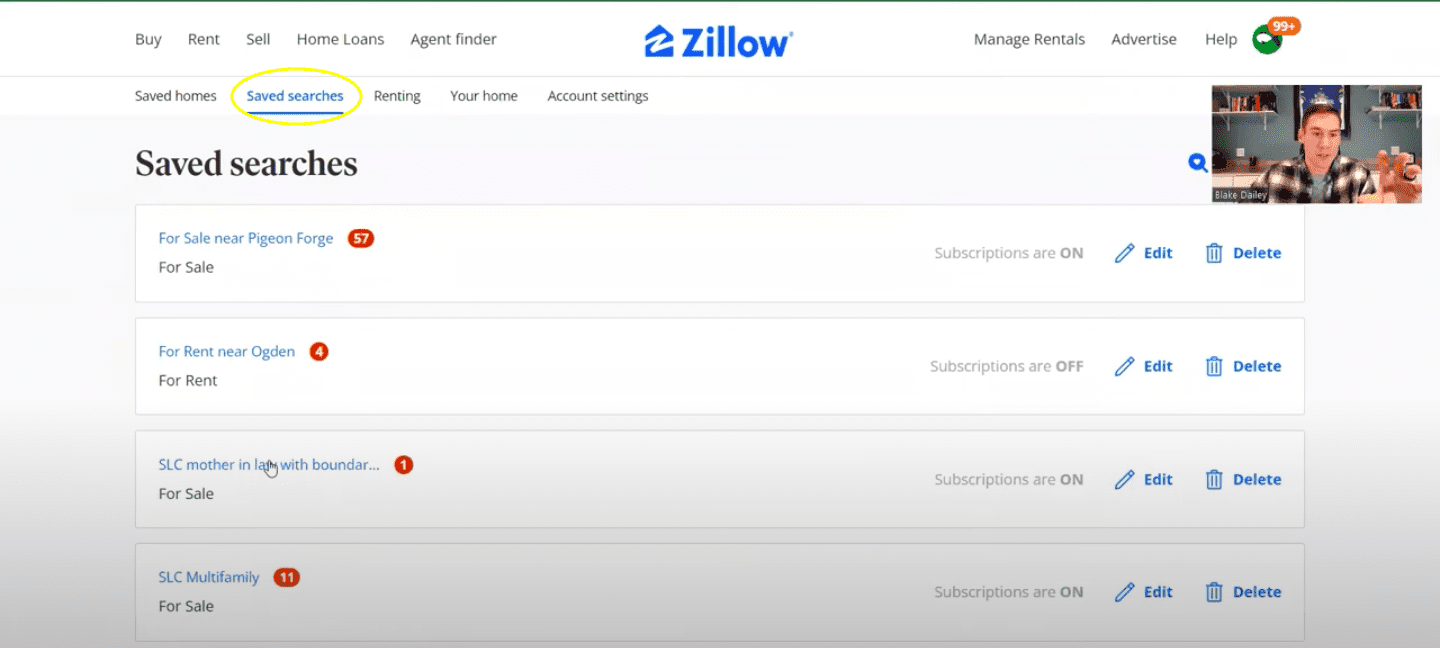

I have here my saved searches. I just create and save these filters.

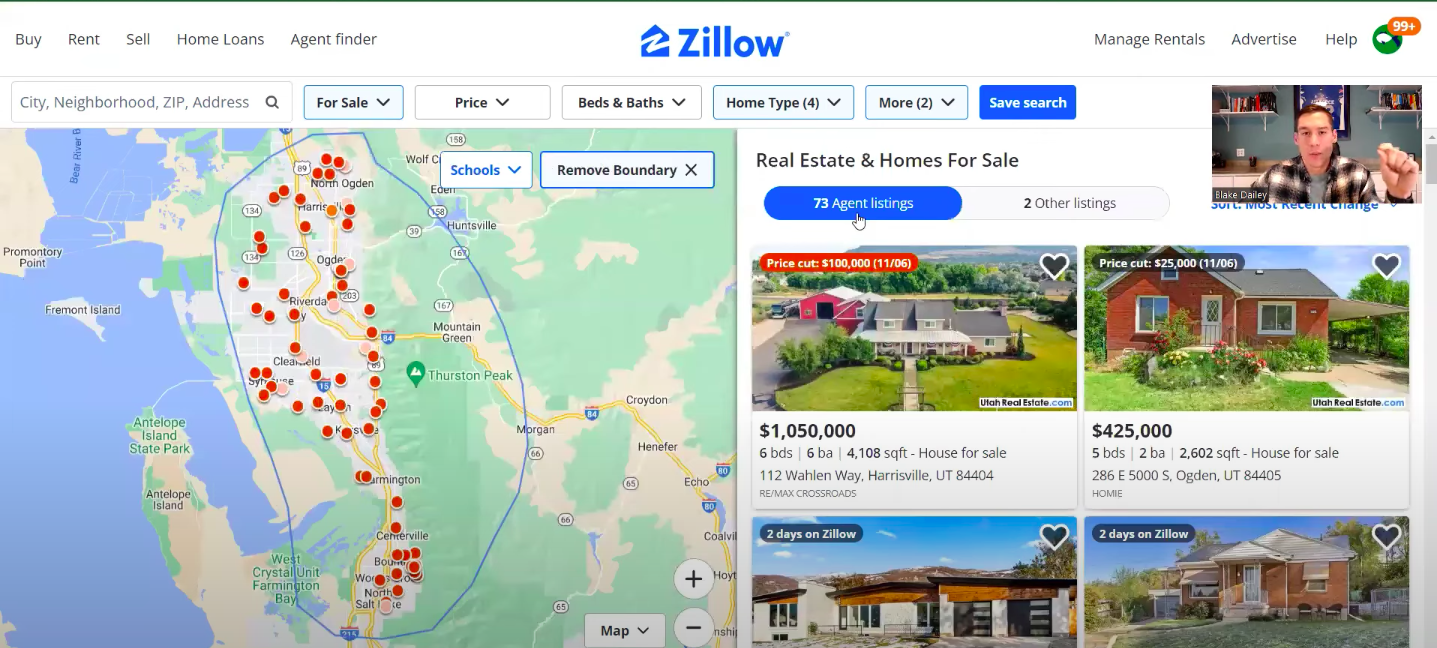

So I’m going to go to one right here, the SLC mother-in-law with boundary. So it just kind of highlights my farm area of places that I wanted to look.

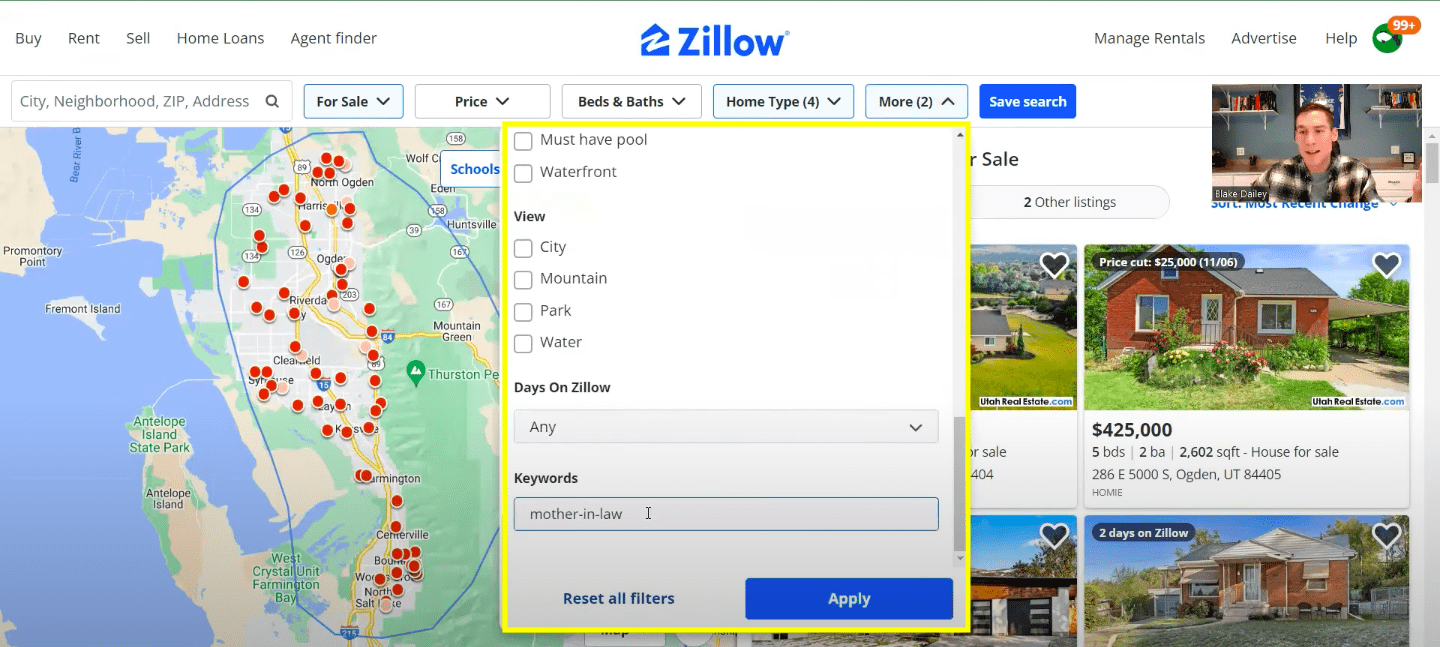

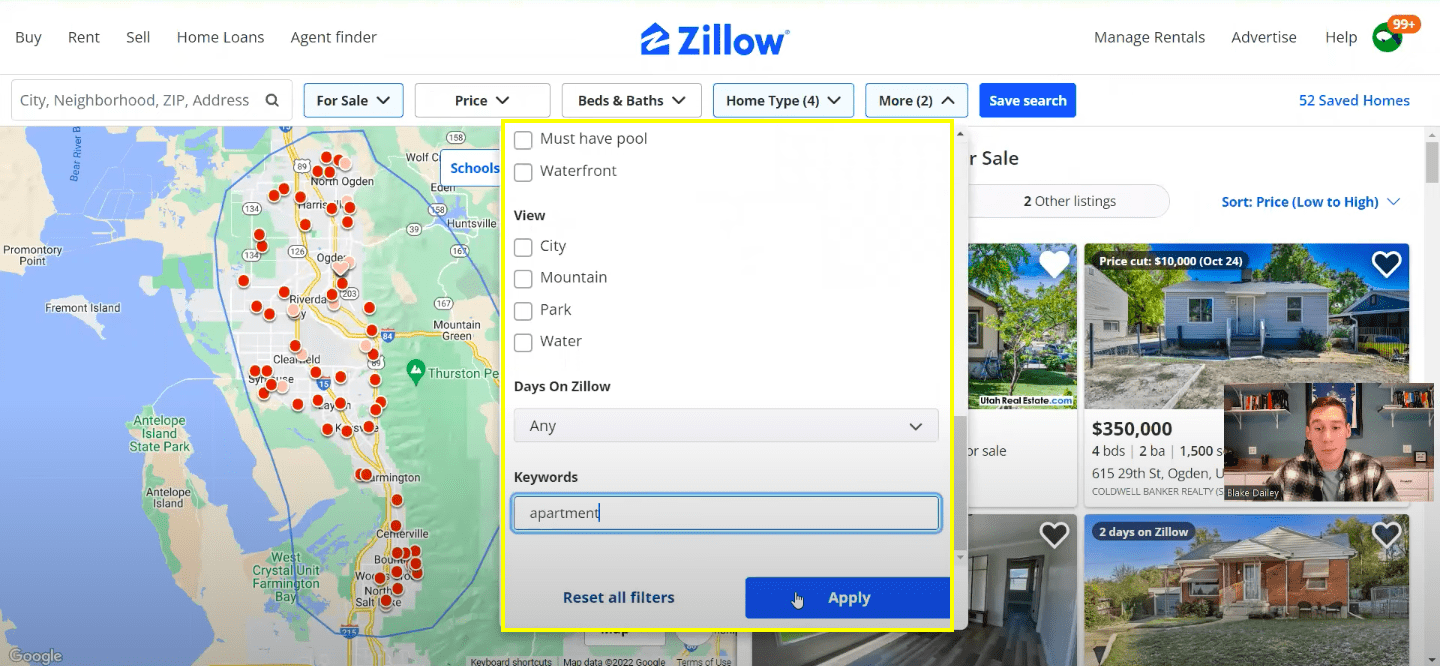

And then one of the most important features here is the keyword filter. So right now I have this set to mother-in-law.

Click apply and it shows all these different properties, 73 listings that have mother-in-law in the listing. And then what I’ll usually do is go from price low to high. Because we’re looking for the best-priced home that we can find.

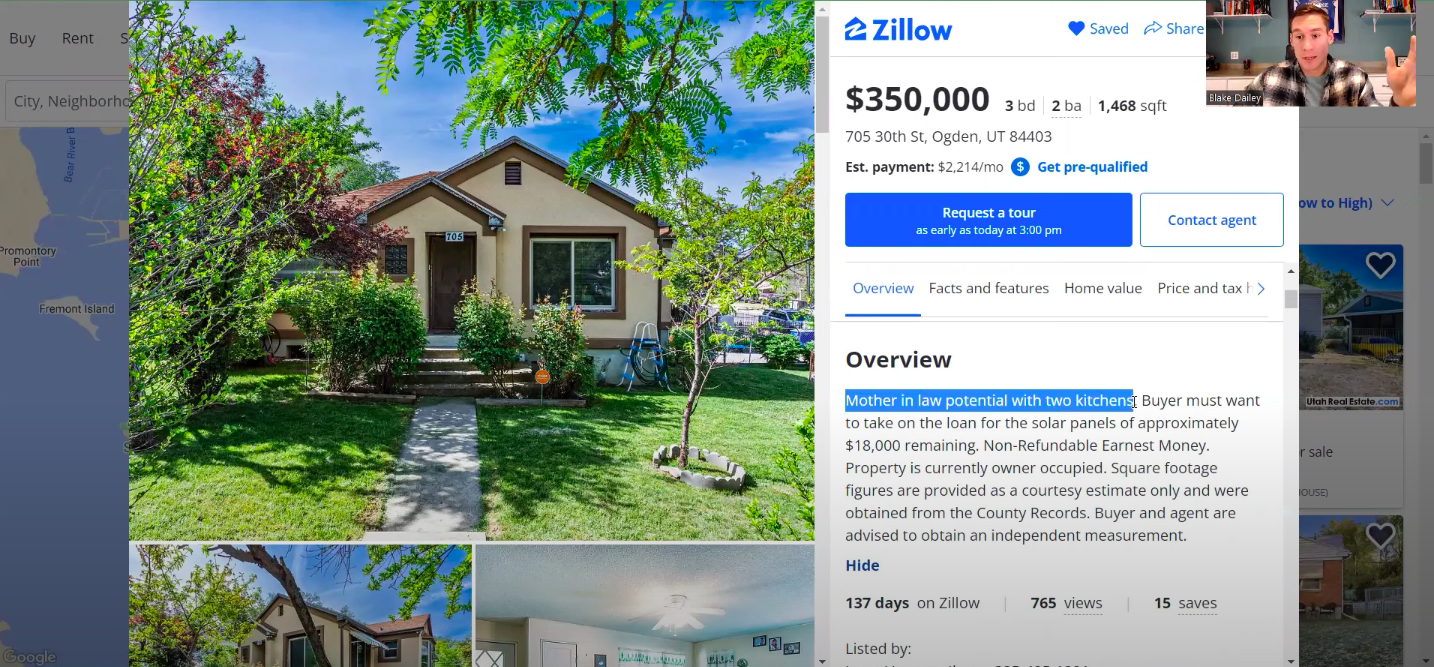

And I hearted this one as just an example. You can see it’s been on the market for 137 days. And this is my area. So you’re just going to be different with the price and square footage and age of the home and different criteria like that. But probably ready for a deal if it’s been on the market for 137 days.

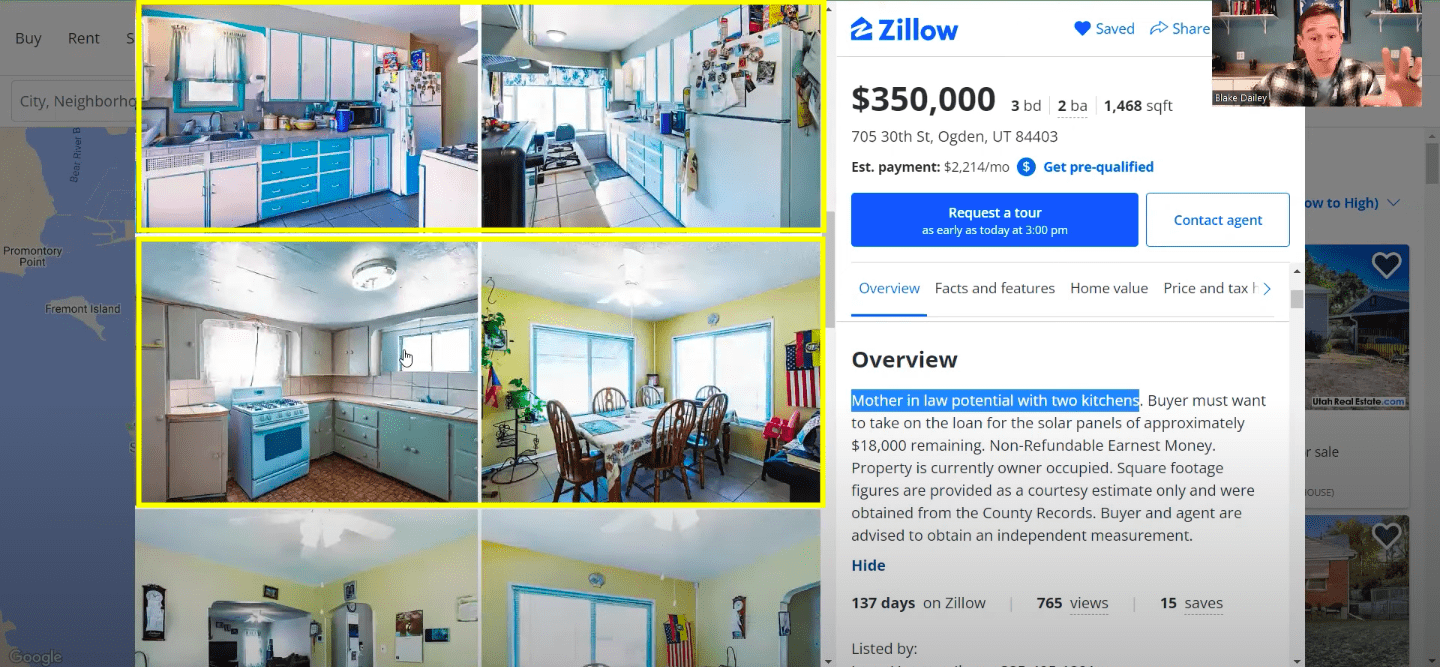

But you can see here what I look for in the listing description is exactly this mother-in-law apartment with potential with two kitchens here. So what I’m looking for now is I know it’s got it but I want to see the pictures and see the condition. So I see one kitchen here and the living room looks pretty outdated. Probably want to update this and put in some TLC. Then you see the second kitchen. Oftentimes when you’re scrolling through the listings, you might just see that second kitchen without even noticing it in the comments. Because like I said, for real estate agents, there’s a very low barrier to entry. So a lot of the time they don’t exactly know how to market these properties.

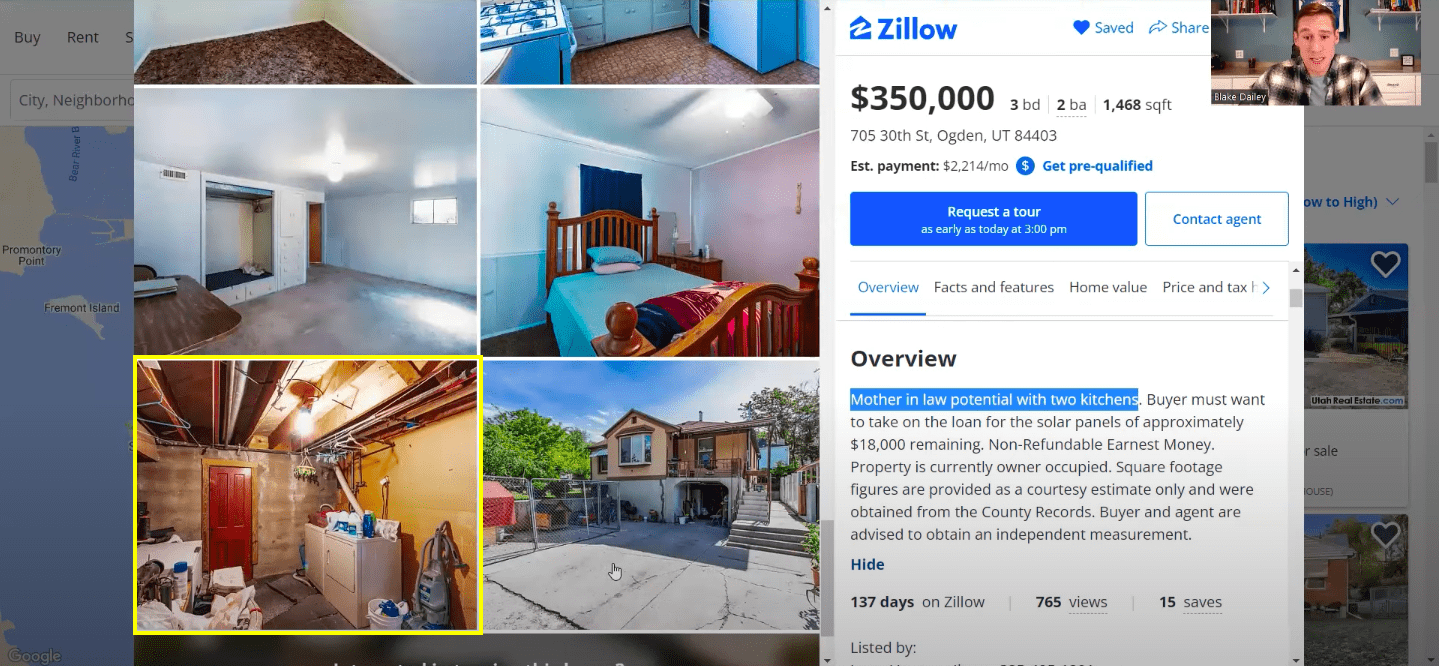

So that’s a really good point about working with a good agent both on the buying and the selling side to get you the best deal in both scenarios. But this one does have a second kitchen. So right here we see in the basement. I would say based on the lowness of the ceilings, these are probably the bedrooms downstairs, a pretty tight bathroom, probably the bathroom downstairs.

So this one definitely needs some work. I don’t know what that is. Maybe the entry to the basement unit somewhere in this area. But you can see it’s got the multiple levels. It’s got this parking area wide enough (probably for two cars). If you were to live in the house or if you were to have two separate tenants, they’d both have parking which is an important thing to think about as well. So this is what I would look for. And I bought several houses this way.

Another one I really like to do is go to the filters and go to look for apartment, apply that and then you get a whole different set of listings here.

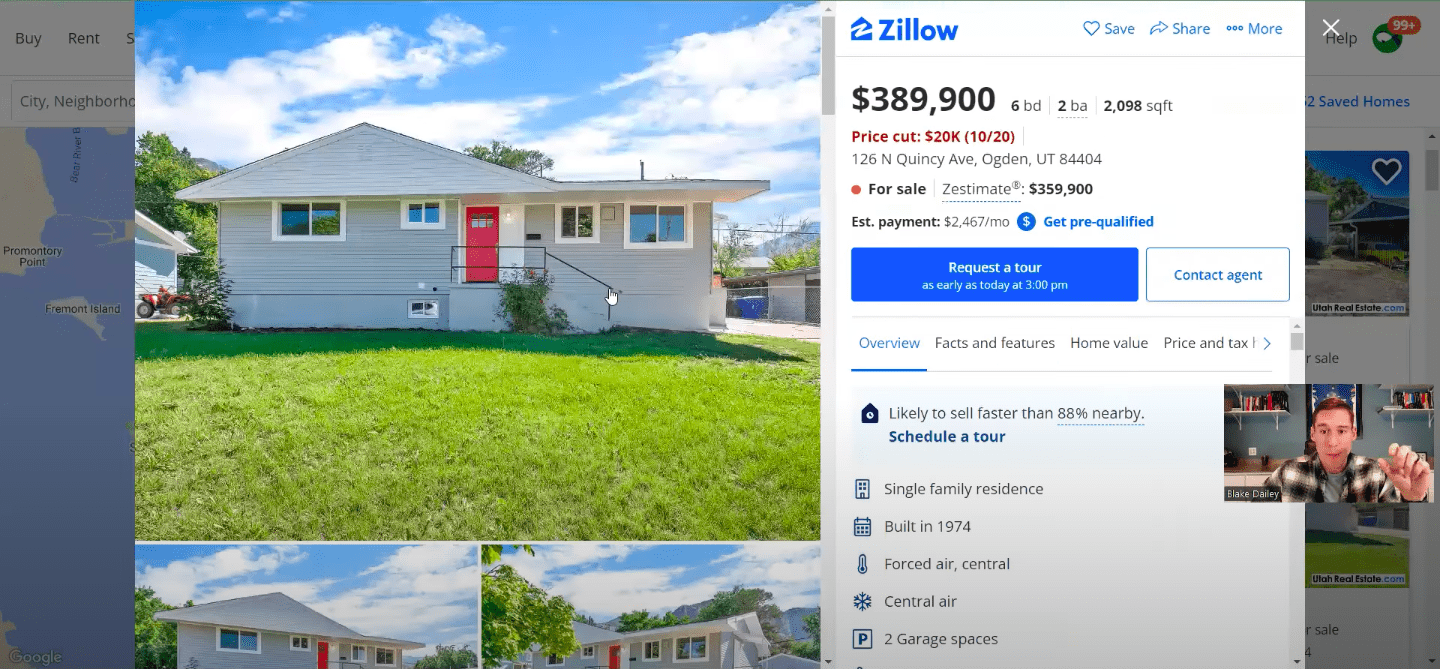

So I was looking at this one a minute ago, but as you look in here, built in 1974, not crazy old, just had a price cut. So they’re probably looking to make a deal as well.

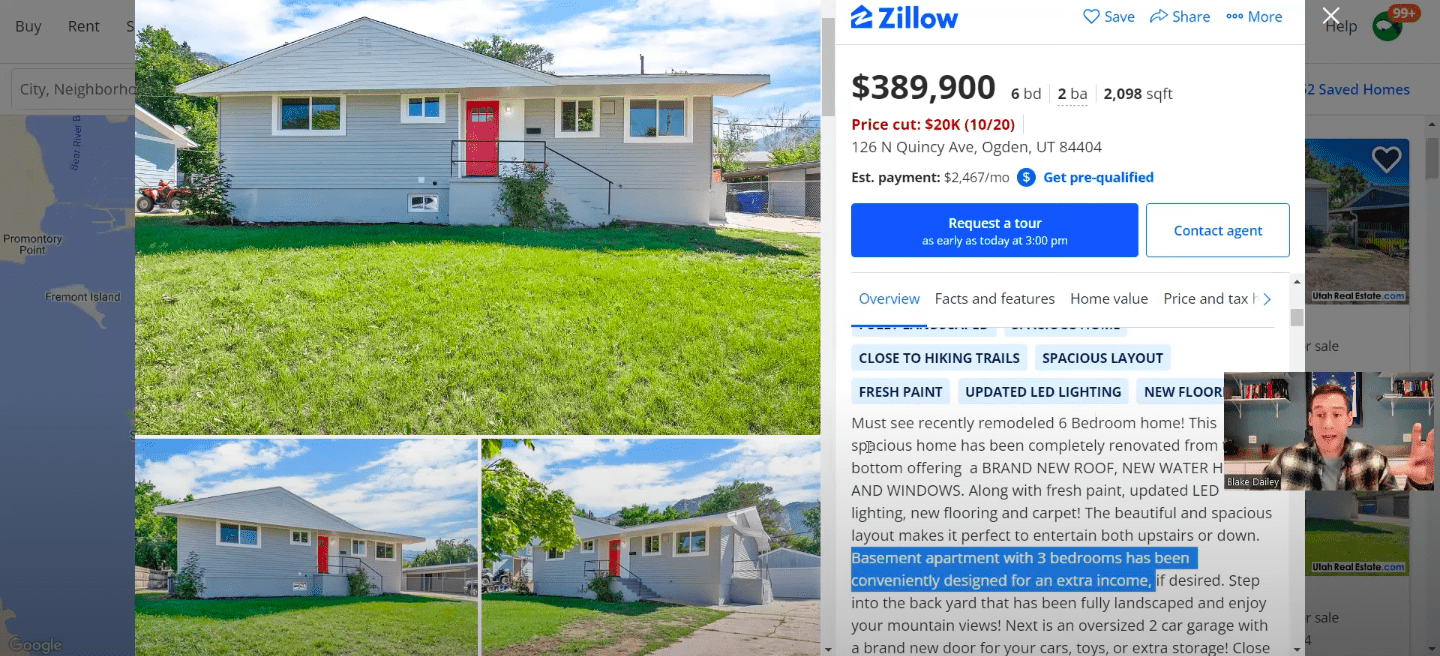

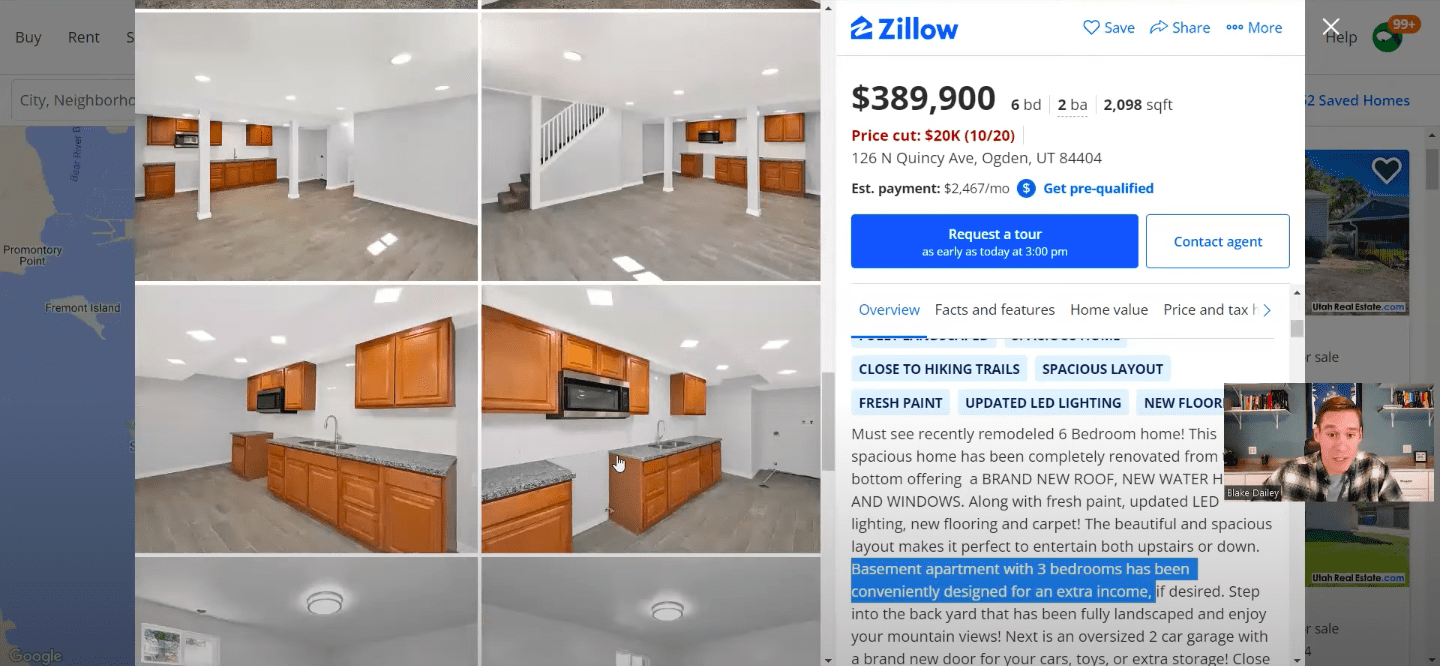

And then on the listing notes here, kind of just read through, see basement apartment with three bedrooms has been conveniently decided for extra income.

So right now at this stage, you’ve identified that this is a potential deal. And it’s a lead, but it might not be the best deal. You still have to run your numbers on it. But this is how you kind of fill the top of the funnel of getting these properties in to be able to screen them and see if it’s going to be a good deal.

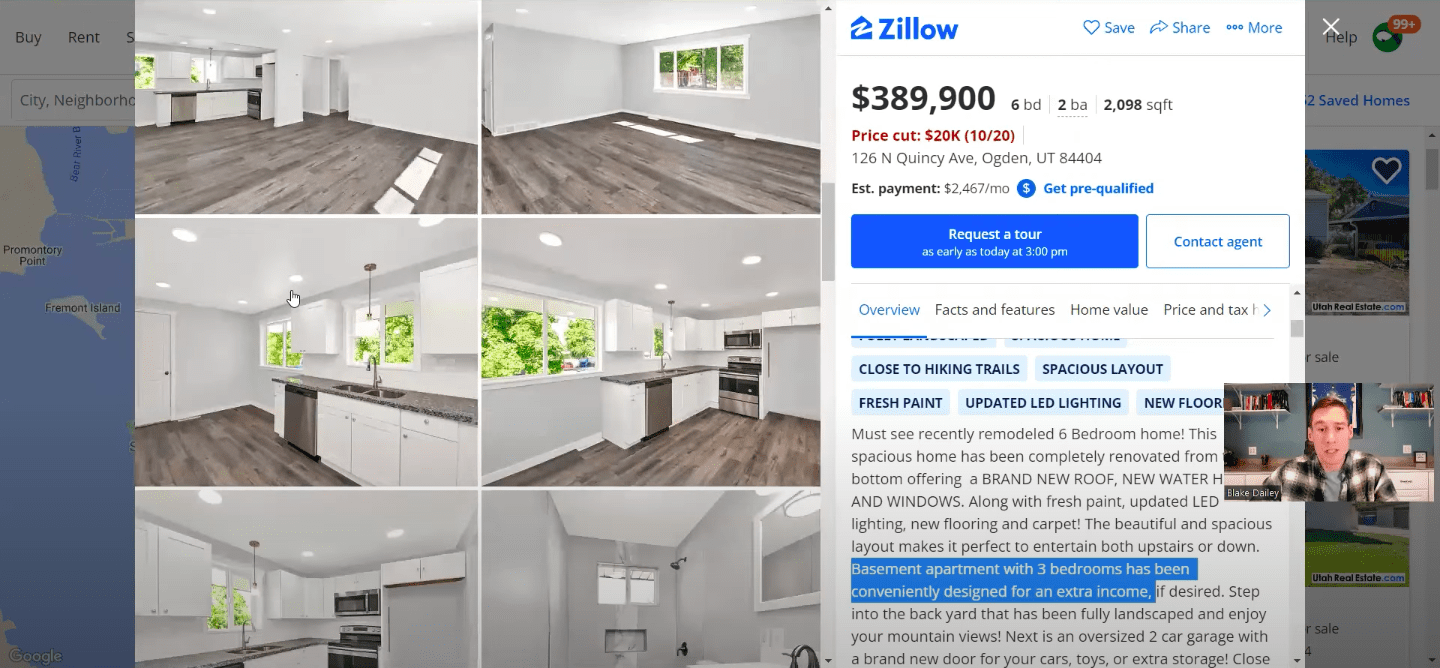

So this is an open living concept with the living room and the kitchen here. Bathroom is renovated pretty nicely.

And you see the stairway. So this is probably the basement here with that second kitchen. Obviously missing appliances so you’d have to factor that into your cost to turn the listing into a rental. Nothing crazy.

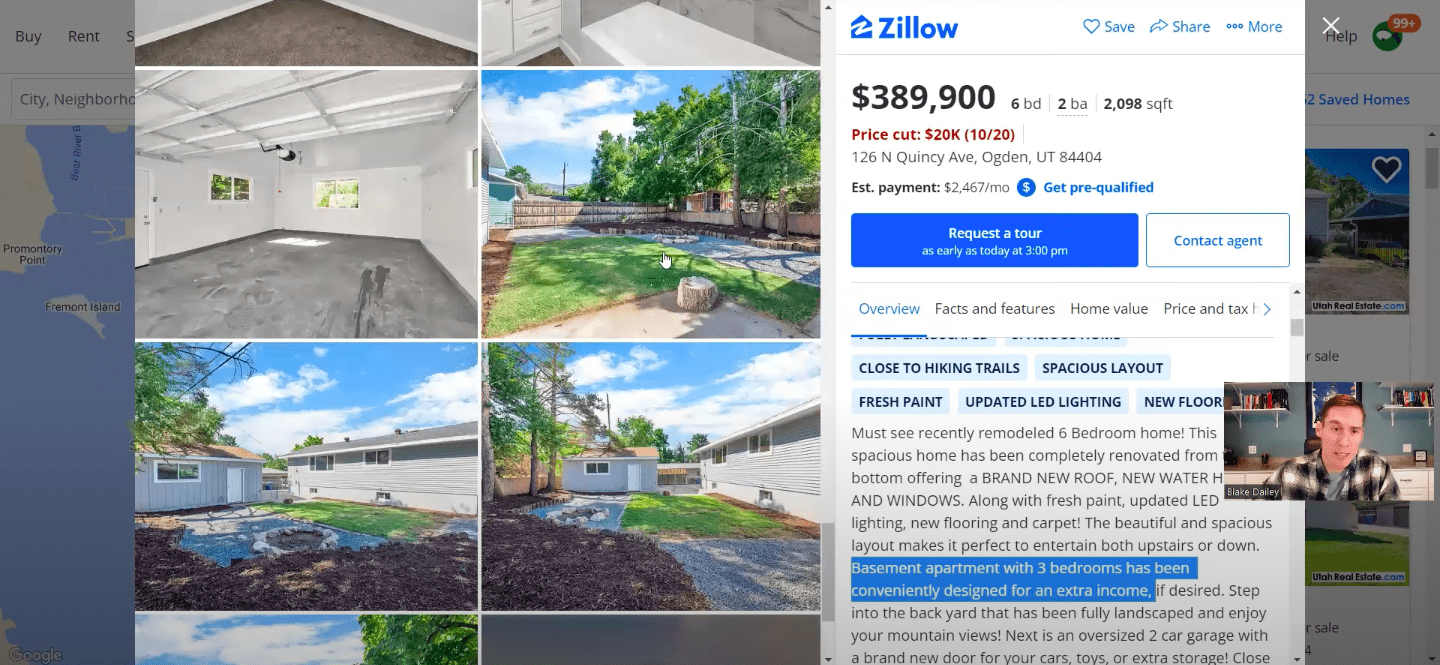

But then you think about the marketability to tenants it’s got this nice outdoor space. Looks like street parking garage for the person in the main home. It has a big driveway. So it looks like they got the parking, they’ve got the extra unit. This could be a potential deal.

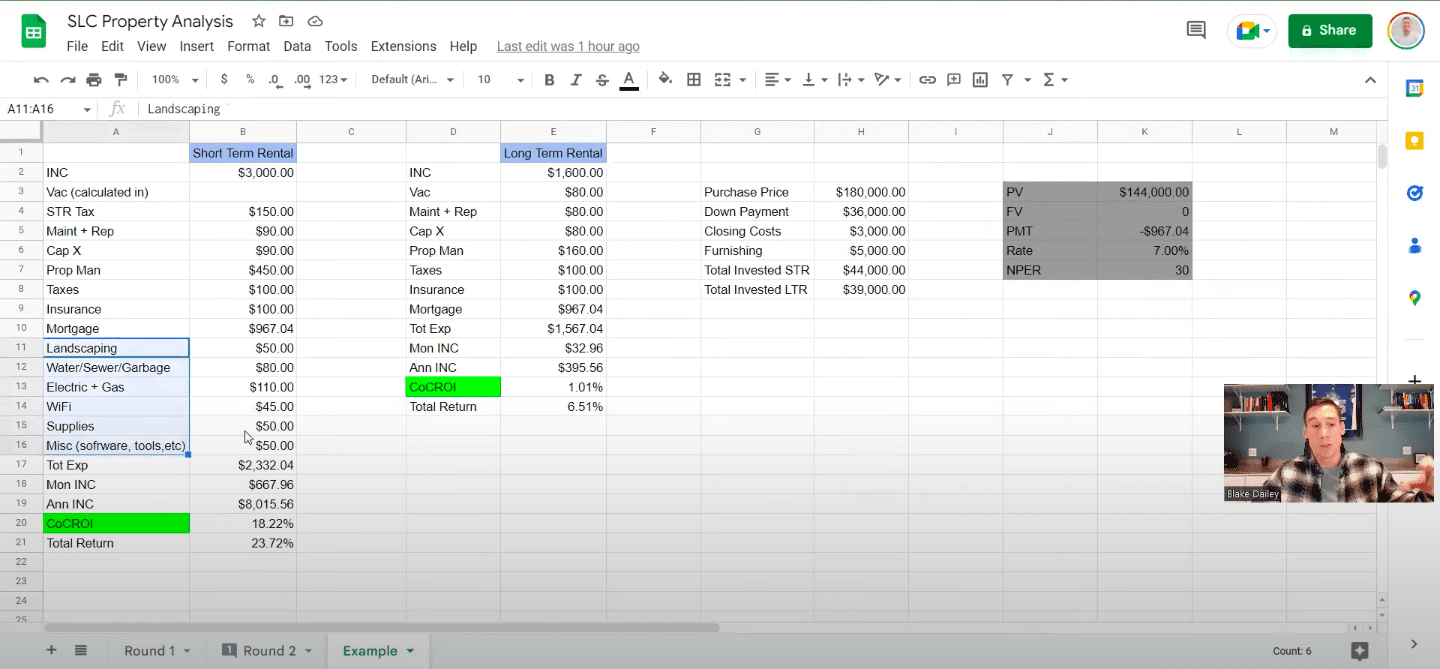

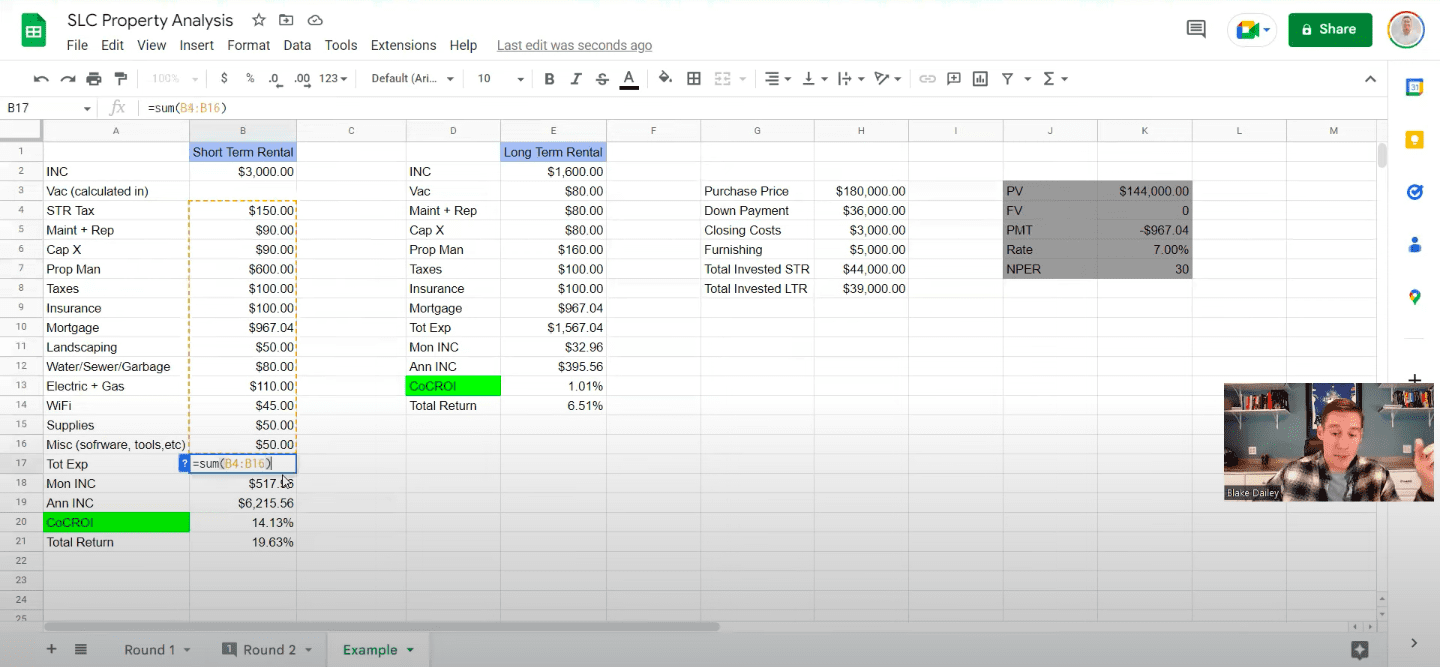

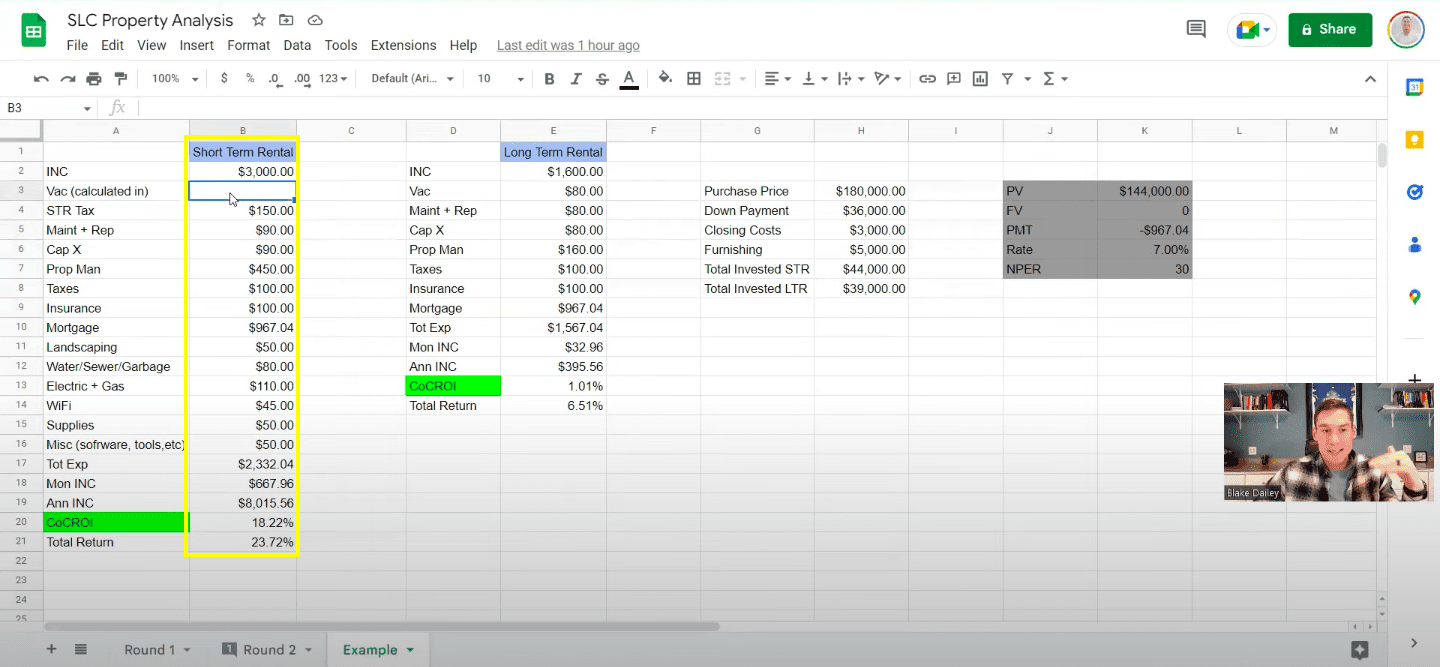

So what you want to do is go in and analyze these properties and kind of decide your strategy. And what I do mostly is short-term rentals. So I’ve got the two different scenarios here, short-term rental and long-term rental. And the difference is basically all the expenses under the mortgage. On the short-term rental side, you’re going to have to pay for landscaping, water, and garbage because you have a short-term rental. Obviously your guests are not going to pay your utility bills for you so you’ll have to pay for all the utilities. Same thing with the electricity and WiFi. That’s one you often forget and it’s cheap though that normally ranges from $40 to $60 a month. These are just example numbers too.

Supplies are something you got to think about as well such as soap, shampoo, dish soap, sponges for the kitchen, all those different supplies that you need to replace every handful of reservations or whatever it is, maybe every month if it’s just one unit. And then you want to total up all your expenses, I think the rule of thumb for the short-term rental tax, I just put 5%. That’s what we pay in our Panama City beach market, for example. And some markets don’t have this but I put it here just to have you thinking about when you look at these properties, maintenance, and repairs usually 5% over on the long-term rental side so I put 5% as kind of the rule of thumb for vacancy, maintenance and repairs and CapEx. Depending on the age and the condition of the home, you can increase these or lower them. But I think 5% is a good rule of thumb. Then I just went with something that would be a little bit higher than that for the short-term rental side because you’re going to have more guests in and out, maybe a little bit more wear and tear on the carpet or certain appliances, the couch, different things like that.

With the nuance of short-term rental, guests usually take better care of your property than a tenant would that’s living there all the time. You have vacancies typically 25% to 35% depending on your market over the course of the year. So it sits vacant a good portion of the time. So it’s not always being used whereas you have that with the long-term rental.

But sticking in this column b for the short-term rental I didn’t include vacancy because that’s typically how I do it anyway, calculated into the projected monthly incomes. So if it was $3,000, I would take what the market occupancy is times the market average daily rate and get the projected monthly income. So say the vacancy was 50%, the average nightly rate was $500, and you’d have $2,500. So including the vacancy in my rental number and then as you go through property management, I put 15%. It can be as high as 20% depending on your area, maybe even 25%. But if you’re going to live there and horseback, you might just take that off of both of these scenarios if you’re going to manage it yourself. But I like to project it with the property management in place because at some point in the future, you’re going to move out of the next house and turn this into a true rental. So you want to project and make sure that it cash flows or at least gets to your desired outcome. With property management in place, of course, your taxes, insurance, and mortgage are going to be the same whether you do short-term rental or long-term rental, depending on maybe your insurance.

And then what you do is total up your expenses and then take your projected income minus your projected total expenses to get your monthly income. Then, divide by or multiply by twelve to get your annual income.

And then what I think is really important is not just looking at that gross number. But also look at your cash on cash return. That’s what the COC ROI is, your cash on cash return, which is going to be your total invested over your annual income. That’s how much you’re making on an annual basis on the money you’ve put into the property. And then for total return, this is kind of up to you. But I put in here like a 5% and then projecting like you’re paying off 0.5 of your principal every year. So it adds to your total return with your principal pay down and also your market appreciation.

Then over here on the long-term rental side, typically what you see is kind of in line with these numbers is about half. You’d make about half if you rented long-term rental compared to short-term. And of course that’s market dependent. But using this for example purposes, right, because once you find the property, it’s the house with the guest house and the mother in law apartment. You have the option to rent it out on Airbnb, VRBO, or just put a tenant in there. Both are completely feasible. I’ve done both and it works. Just depends on what you want to do, how active you want to be, and I guess your own flavor of investing.

But again, you’re going to obviously see much lower annual income, based on the difference between short-term rental and long-term rental. And then what my advice would be to make sure that as a long-term rental you can at least break even, especially if your main strategy is going to be short-term rental because you want to have that downside protection. If you have a really slow market, if your area changes its regulations and you can no longer do stays less than 30 days and you have to go to long term, then make sure that as a long-term rental, you can still at least break even and then your total return based on the appreciation. Obviously, if you’re in a Southern California market, or somewhere that appreciates well, this might be like 10%, and then you’ve actually got a pretty good return based on the money that you’ve put in, which in this case would be just that difference minus the furnishing. So you’re going to put in the same amount of money to get those two investments up.

Short-term rental, you’re going to have to furnish the place when you’re going to do it, bring it.

Long term rental, your tenants are going to bring their own furniture. And this just gives you a little mortgage calculator using the payment function here and your inputs based on your purchase price.

And that is where that comes from. Now, the thing that I can tell you, that I can’t necessarily teach you how to do it because it really goes into your style of investing, the kind of properties you’re looking for, like what your ideal investment is. But what I want to tell you is look for the photos, especially if you see something that may be like a photo that’s got a house in the background or it’s got some extra building or space that might be able to be converted. Like, for example, I will show a house we bought in Florida that we lived in for two years and made a little bit of money the whole time when I first saw this listing, I saw this back in the background here. But that is the apartment right here. This section in the front is the garage. And it kind of just talked about having the extra garage space and just happened to mention the word apartment back there and then had a few photos of the actual apartment. But it just kind of went right from the main house into this apartment. So you couldn’t really discern what was what. And the listing was very bad. But just by doing the strategy a lot, looking for houses with the guest houses, because that was kind of like my main thing at that time I found this. So by looking for whatever it is in that listing, it could be the extra kitchen, it could be a space in the basement that could be converted. Another great strategy, like creating that rentable unit with extra space or having some kind of detached space or detached unit that you can create and turn into that extra rentable unit. Especially it’s really nice when you live in the main house and it’s detached and then you really never have to interact or share a wall with your tenant or your guest if you do short-term rental. So those are some tips, additional tips on how to find properties like these. I hope that’s helpful for you.

All right, so I hope this quick and dirty was helpful to show you what’s possible when looking for deals. Yes, the market is in turmoil right now and more or less interest rates are really high, but you can still find good deals. It’s all about how you approach it, what you’re looking for, and how you can kind of expand your creativity to find good deals that might be sitting right in front of you or on Zillow that you’re just skipping by because you’re not looking for the right things. So yes duplexes, triplexes, and fourplexes can still be great investments, but I’ve had much better success in my own history of buying these houses with a guest house. I think seven in total now, a lot of equity, all have been cash flow positive. It’s breaking even while I’m living there, even making a little bit of money. And it’s how we’ve built up a lot of wealth so far. And that has given us the experience and the repetitions to get into bigger deals and feel prepared for those bigger deals by just stacking up a smaller portfolio, getting really good at this one investment strategy by looking and learning how to find these different deals. I promise you there are deals out there. It’s just how can you change your parameters to find better deals in this tough market. As I said, we’re in Ogden, Utah which is a very competitive market. We bought an almost $800,000 house, which is just crazy for me to think about, especially when we started investing and could barely afford a $200,000 house. But it’s because it has these extra rentable units. And that’s why I think you can do it in any market in the country, no matter where you’re at, by being smart, by out-competing on the search side of your deal criteria, and how you can find these things. So I hope this was helpful. Don’t forget to watch the full YouTube video where I walk you through how I look for and find great househack deals.